Credit Card vs. Debit Card Options for Kids

Even though kids younger than 18 can't get credit cards of their own, parents still have options to use credit and debit cards to help their kids enjoy a bright financial future.

As a parent, there are lots of reasons why you might be thinking about getting your child a credit card or debit card. Maybe you want to jumpstart your kids' credit. Or you want to teach them about budgeting, saving and spending money. Perhaps you just want to give them a way to shop without carrying cash.

Setting goals and understanding your options can help you make the best choices for your family.

Takeaways: Pros and Cons of Credit Cards vs. Debit Cards for Kids

- Adding your child as an authorized user to you credit card can help your child build credit — as long as you keep your credit utilization low and pay the bill on time.

- An authorized user's credit habits will affect your credit score, and your credit habits will affect theirs.

- Secured credit cards can help young adults with little or no credit history start building credit.

- A debit card can help a child learn how to make purchases with a card and manage money in their checking account, but it won't help them build credit.

- Children ages 13 and up can have access to online banking to review their accounts.

- Prepaid debit cards can help teach kids how to use a card to pay for transactions and prevent them from overdrawing the account.

Comparing Kids' Credit Card and Debit Card Options

Different types of credit and debit cards have features that can help you accomplish various goals. Accounts come with different levels of responsibility for you and your child, ranging from all the responsibility on the adult to all the responsibility on the child.

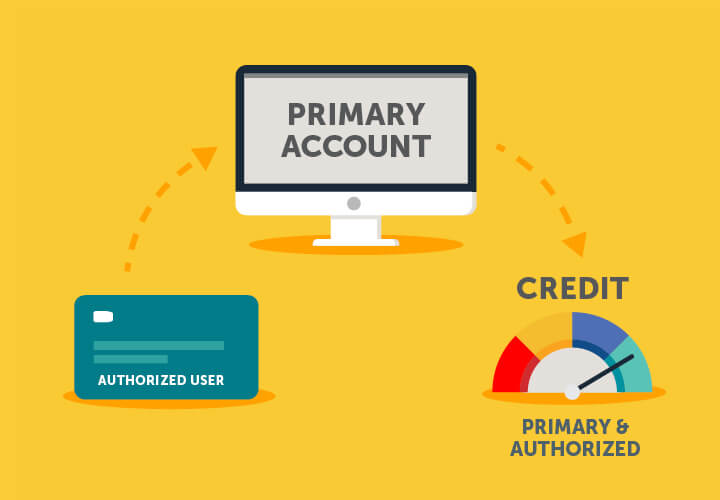

Authorized User on Parent's Credit Card

The easiest way to help your teen get a credit card is to add your under-18-year-old as an authorized user to your card account. Different card issuers set minimum age requirements for authorized users.

If you make your teen an authorized card user, a card with your teen's name will be mailed to your home. Charges on the card may be reported to the credit bureau for your child's file and help to build credit — if the issuer reports the child's use.

Depending on the card issuer, the child may be able to log in, review their charges and make payments, depending on the card and issuer.

Ask the card issuer if it reports the authorized user to the credit bureaus. If it does report the use, a card could help your child build a future credit history.

An authorized user card gives you the chance to teach your child valuable money lessons, including:

- Good credit habits: Budgeting and how to set spending limits.

- Bills: How to read a credit card bill.

- Monthly payments: Making regular, timely payments.

- Credit usage: Spending less than 30% of their credit line.

- Interest: Why and how interest payments affect how much you owe.

- Avoiding scams: How to protect a credit card and avoid phone or text scammers who ask for the card's number or pretend to be the bank.

- Card management: How to keep a card in a safe place, tell the bank if you're traveling and other housekeeping tips.

Example: BECU Authorized Credit Cards and Kids

BECU asks authorized users to meet a minimum age requirement of 13 or older. As the primary cardholder, you remain responsible for ensuring the credit card is paid on time. You're also the only person who can view transactions and make payments.

The authorized user's credit card is the same number as the account holder's card, explains Meghin Margel, director of BECU's lending solutions.

"The primary account holder gets the bills and applicable cash back and is responsible for the payments," Margel said. "It's a great introduction to credit and a credit-building tool for the authorized user."

Pros of Adding an Authorized User

- If the card issuer reports the authorized user to the credit bureau (some don't), your child's credit history after turning 18 could reflect the payments and amounts owed.

- Gives you a chance to oversee your child's initial card use and discuss money and debt management. You may need to pay close attention to card statements for a while.

- May provide your authorized user with benefits such as extended warranty protection and emergency travel assistance — this could be helpful if your teen is going on a school trip.

Cons of Adding an Authorized User

- An authorized user of your card will affect your credit. For example, if your child maxes out your card, it could lower your credit score.

- Your card use will affect the authorized user's credit. This is fine if you pay bills on time and keep your balance low. If not, your child's credit score could be damaged.

- You're responsible as an adult and primary account holder for paying the credit card bill, even if your young, authorized user spends up to the limit.

Example: Monica called her credit union and added her daughter, Erin, as an authorized user to her credit card account. Monica has good credit.

When Erin buys a new laptop with the card, Erin can help pay for these charges. But Monica is ultimately responsible for paying the credit card bill, even if Erin doesn't help pay the charges.

Monica can also remove Erin at any time from the credit card account. But Erin cannot remove Monica.

Monica can see everything Erin charges on the account. Monica receives credit for any cash back, points or miles earned.

When Erin turns 18, as long as the card is well managed, it can contribute to a better credit score.

However, a late payment or using too much available credit will decrease Monica's credit score and bring down Erin's score at age 18.

Secured Credit Card for Young Adults

After your child turns 18, they may be ready for their own credit card, and a secured credit card could be a good introduction.

Many young people use a secured credit card to build a credit history. Your cash deposit (or "collateral") secures future charges with the card. Like a regular card, a secured credit card must be paid monthly as a minimum payment or in full.

Pros of a Secured Credit Card

- Builds credit like a regular credit card.

- You can only spend what you've deposited.

- Can graduate to a credit card with the same issuer after establishing credit.

Cons of a Secured Credit Card

- Only available for those 18 and older.

- Your money is unavailable to you while in secure deposit.

- Late payments can damage your credit score.

Example: Your 18-year-old son uses $500 to secure the card; as a result, your son can charge up to $500. If he charges $100 in one month, he might pay it back over two months, at $50 each time.

Student Credit Card

Major credit card companies offer student cards aimed at college students and those with lower credit scores.

A young adult still needs to show an income source. Student loans don't count as income for some card issuers, including BECU. If your adult teen doesn't have an income source, you (or another adult over 21) can co-sign or joint-apply for the credit card if the issuer allows it.

If your kids are looking for a student card, help them compare options, including points or travel miles for a rewards credit card, interest rates, fees and other details.

Remind your young adult not to apply for cards too often, or they'll experience a credit score drop.

Pros of a Student Credit Card

- Builds credit history.

- Your teen may be able to get cash back or other perks with the card.

- Doesn't require a perfect credit score.

Cons of a Student Credit Card

- Only available to those over 18, typically with income.

- Can have the same potential problems as any other credit card, including credit score drops due to overuse or late payments. Remind your child to set up automatic payments to help avoid a forgotten bill.

- If you co-sign to help a teen get a student card, your credit score is at risk. If your adult child doesn't repay that credit card debt, you're responsible — and unpaid bills can hurt both of your credit scores.

Debit Cards for Kids

A debit card might be another good place to start with your younger teen. In the future, you can add them to your credit card account as an authorized user.

However, use caution, especially if you have a child who constantly loses things: A lost debit card could lead to a drained checking account if it falls into the wrong hands. (Note: Contact us immediately if your BECU credit or debit card is lost or stolen.)

A child or teen checking account often comes with a debit card. BECU offers a free checking account that children or teens can use. A parent or legal guardian must be a joint account holder if the primary member is under 18 years old.

A bank account is a good place for a first paycheck or babysitting money to introduce the concepts of earning interest in a savings account and not outspending your means. Think of it as training wheels for an actual credit card.

Note: If a minor attempts to use a BECU debit card and the transaction is more than their checking account balance, the transaction will be declined. There are no BECU debit card overdraft fees unless the member (over 18) opted into the Optional Overdraft Service for Debit Card Transaction. However, a minor could still be charged non-sufficient funds fees.

Pros of a Debit Card for Kids

- A debit card can help your child learn financial responsibility basics such as keeping a card in a safe, dependable location, staying within spending limits, using a card for purchases, checking on balances and monitoring for fraud.

- Children who are 13 and older can have access to Online Banking.

- You can monitor their spending and ability to budget, as a parent or guardian typically must be a joint account holder until the child turns 18.

Cons of a Debit Card for Kids

- A debit card doesn't build credit or go on your child's credit history in the future.

- Most banks and credit unions require debit card holders to be age 13 or older.

- Children can't access or view their accounts online or through a mobile app until they are 13, under the Children's Online Privacy Protection Rule requirements.

Prepaid Debit Card

Prepaid cards are another option. As the name suggests, you (or your child) load prepaid plastic cards with funds. Your child then spends the funds, and you can reload the card. Unfortunately, many prepaid cards charge fees for card use.

Pros of a Prepaid Debit Card for Kids

- Children of any age can use a prepaid debit card.

- Can help protect against overspending because you control how much is on the card.

- Can help kids grasp how plastic works versus cash, including how to use it at checkout.

- Can be loaded with limited funds to help avoid larger losses from a lost debit card.

Cons of a Prepaid Debit Card for Kids

- Often charged fees for use.

- Tracking spending can be challenging.

- Doesn't build child's credit or show on child's credit history in the future.

- Doesn't offer some of the tools of a typical secured or unsecured credit card and isn't as great for "practice" as other options.

- If lost, you cannot retrieve the funds unless you registered the card.

At What Age Can a Child Get Their Own Credit Card?

Depending on the card issuer, your child must meet the company's minimum age requirement (generally 18) and show proof of independent income to demonstrate an ability to repay borrowed funds.

The card's payment history and balances will then go on your child's credit report, which the child can review. At BECU, a person must be 18, or a legally emancipated minor to apply for a credit card.

Will a Child Have Their Own Credit Card Bill?

Typically, young adults may not have their own bills for authorized user credit cards. To teach financial responsibility, review your joint bill every month alongside your child.

Once your child turns 18, some issuers will send a statement to your child. (BECU doesn't send separate statements to authorized users.) If your child has a secured credit card or student credit card, they will receive the bill.

How Do I Get a Credit Card for My Child?

If you hope to add an authorized user to your credit card account, call your bank or credit union to ask how the process works where children are concerned. After adding your child as an authorized user, your child will receive a credit card in the mail for activation and use.

If you're the parent to a child over 18, your child could also get a credit card if you co-sign the application.

Should I Co-Sign a Credit Card for My Child?

Don't co-sign unless you're willing to repay your child's debt in full, in addition to any late-payment charges or other fees. Remember that any bad credit outcomes related to unpaid charges and late-payment fees will also affect your credit history.

What's the Best Way To Build Credit History for My Child?

A good way to build a child's credit history may be through adding your child as an authorized user.

After age 18, a secured credit card offers another way to build credit through staying within a credit limit and paying bills on time.

One Thing You Can Do: Prioritize Your Goals

Before you start an application for a credit card or request a new debit card for your child, consider why you want your child to have access to these payment methods.

Do you want to teach your child how to pay with plastic? Are you helping your child get a jumpstart on building their credit history?

Once you understand what you are trying to accomplish, make a list of pros and cons to compare your options and choose the one that works best for you and your family.

Approval subject to BECU membership, credit approval and other underwriting criteria; not every applicant will qualify. Credit Card programs, services, rates, terms and conditions are subject to change without notice. Contact BECU for the most current information.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized financial, tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation when making financial, legal, tax, investment, or any other business and professional decisions that affect you and/or your business. Linked third parties are solely responsible for the delivery and quality of their products and services. BECU does not guarantee nor expressly endorse any particular product or service.