What Is a CD and How Does It Work?

If you're hesitant to jump into opening a certificate of deposit because you're not sure what they are all about, we've got you covered. Learn the basics like what a "term" is, the different types and the pros and cons of investing in CDs.

For those in the know about personal finance, a certificate of deposit, or CD, is a hot topic right now because interest rates are higher, on average, than they've been in more than a decade. But if all the talk about interest rates and term lengths has you scratching your head, you might hesitate to put your money into one.

What is a CD exactly? Is there more than one type? How long do you have to keep your money in a CD?

Understanding the basics of what they are and how they work might help you decide if a CD is right for you right now, and compare CDs with savings accounts and other savings tools.

"Everyone's financial situation is different," said Scott Smith, head of BECU's deposit product strategy, who has served the credit union industry for 22 years. "Like any financial tool, you'll want to think about whether a CD helps you meet your own needs and goals."

What Is a CD?

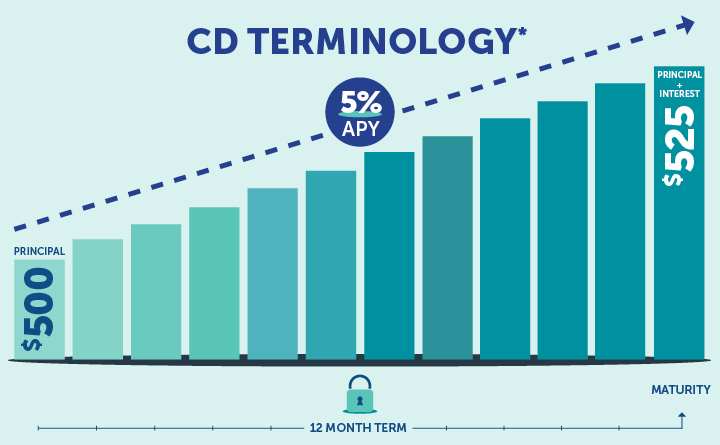

A certificate of deposit, or CD, is an account you can use to save money and earn interest. You agree to deposit your money and keep it in the CD for a specific length of time without withdrawing it. In return, your financial institution pays the interest rate offered when you opened the CD. If you withdraw your money early, you likely will pay a penalty.*

We'll get into some of the different types of CDs below.

How Do CDs Work?

These definitions can help you understand how CDs work:

Term

A term is how long your money stays in the CD account. You can choose a term that ranges from a few months to several years, depending on the term lengths offered by your financial institution.

Principal

This is the amount of money you deposit into the CD that the financial institution applies interest to.

Interest and APY

Interest is your earnings paid as a percentage of your deposit. Your credit union or bank pays you interest in exchange for committing to the term.

When comparing rates, you may also see the term APY, which stands for "annual percentage yield." APY is how much your money would earn (as a percentage) if you keep your money in the CD for one year. The APY should be slightly higher than the interest rate due to compound interest — the interest your money earns on your principal plus interest.

How your CD's interest is calculated, credited to your account and accessible to you varies by financial institution. For example, compounding interest may be calculated daily, monthly, quarterly or yearly. Some financial institutions might compound interest daily, but not credit the interest to your account until the end of the term.

You also might be able to withdraw interest (but not the original principal) regularly, or you might be required to roll your credited interest back into the CD until it matures.

At BECU, you can choose to have your CD interest remain in your CD, or have your interest automatically transferred monthly to your BECU checking, savings or money market account.

Tip: The best way to maximize your earnings is to keep the interest in your CD for the whole term, even if you could withdraw it. With compound interest, you'll earn more on your principal plus interest. Check your account disclosure for details.

CD Maturity

Your CD reaches maturity when its term ends. Your CD's maturity date will be specific and set when you open the account. After that date, you can decide whether to roll the CD over to another CD or withdraw your initial deposit and any earned interest.

CD Penalties

Most credit unions and banks have early withdrawal policies if you want to take your money out before the CD maturity date. These policies likely will require you to pay a penalty for withdrawing your funds.

Penalties typically only add up to a few months of interest, Smith said. Usually, the principal you put in isn't reduced, but can be.

Smith suggested that you do your research on the financial institution and any fees before locking your money up in a CD. Typically, penalties are 60-90 days for shorter CD terms and up to a year's worth of interest for longer terms.

CD Penalty Example*

You open a 12-month CD with $500. The CD pays 5% APY. After three months, you've earned $6.14 on your CD.

But your car needs emergency repairs, and the mechanic's bill is more than your emergency savings. You now need to "break" your CD or withdraw it early.

You read the consumer account disclosure. The disclosure says that CDs with terms up to and including 12 months have an early withdrawal penalty of 30 days' interest. The credit union deducts $2.04 as an early withdrawal penalty from your $6.14 then sends you your original $500 deposit plus $4.10.

How To Use CDs: Scenarios

Think of CDs as non-emergency savings options for money you don't want to put in riskier investments, such as the stock market. You can also time the CD's maturity date with the exact date you may need the funds.

Possible uses might include saving for:

- Annual property tax payments.

- Your wedding you're planning for in two years.

- Summer vacation next year.

- Down payment on a first home in five years.

- Home repairs in six months.

- Down payment on a new car in 18 months.

For example, if you know your property tax bill is due in one year, you could put money into an 11-month CD. Or you could save for the upcoming bill using an add-to CD (explained later).

But whatever you do, don't put your emergency fund in a CD.

"If you need the money immediately, you don't want to pay the penalty, even if it's some interest," Smith said.

Plus, it could take a few days to liquidate and move your CD's funds, he pointed out, particularly if you put money into a CD at an online bank or an institution different from where you have your checking or savings account.

Types of CDs

Depending on your situation, it might be worth researching, tracking maturity dates and reinvesting your money in different types of CDs. Some may help you avoid early withdrawal penalties or require low minimum deposits. Consider different CD types to help you save according to your needs.

Fixed-Rate or Traditional CDs

This is the most common type of CD. With this option, you commit to keeping a fixed amount of money in the CD for a specific term, such as three months or 24 months. Your financial institution pays the interest rate offered at the time you opened the CD. The interest rate stays the same for the whole term.

Bump-Up CDs

This is a different type of CD you select at the outset. A bump-up CD helps you keep up if interest rates rise in the future. You could take advantage of a one-time option to request an increase in your rate if rates go up during the term, or the credit union or bank might automatically raise the rate.

Add-To or Add-On CDs

If you don't have much money to invest immediately, you can use this type of CD. Open an add-to CD with a minimum deposit, then contribute to your total over time to earn interest as you go. For example, you might put in $100 now and then automatically contribute $10 per week from your checking account.

No-Penalty CDs

Some financial institutions offer a no-penalty CD, where you can withdraw your money anytime, even before the CD matures. You may find a slightly lower fixed interest rate with this type of CD or only have limited term options, such as 9-12 months. (BECU doesn't offer this type of CD).

Jumbo CDs

Some financial institutions offer Jumbo CDs that reward you with higher interest rates for stashing substantial cash in a CD — for example, $100,000.

IRA CDs

These CDs combine a CD and individual retirement account (IRA). For advice on combining CDs with a tax or retirement strategy, speak with a personal finance expert or tax professional.

CD Investing Pros and Cons

Here are the pros and cons of CD investing:

Pros of CD Investing

- Better returns: CDs typically offer better rates than other deposit accounts such as checking or traditional savings accounts, according to MyCreditUnion.gov — often with no monthly fees.

- Predictable returns: Most investments can't guarantee a return on your money. Fixed-rate CDs pay a stable APY no matter what, and you won't lose any of your principal (the amount you initially put in) as long as you leave the money in the account for the agreed-upon term.

- Can be insured: Just like your savings account or checking account, as long as your CD is at a financial institution insured by the FDIC or NCUA, your deposit accounts, including CDs, are covered for up to $250,000 combined.

Cons of CD Investing

- Money is less accessible: You enter a contract with your credit union or bank agreeing to keep your money in the CD for the length of the term. Even if you break the CD, it might take a few days to liquidate, so you might not be able to get your funds immediately.

- Early withdrawal penalties: You'll pay an early withdrawal penalty if you withdraw your funds before the end of the agreed-upon term. This amount is usually a few months' interest. You won't pay this penalty with a savings account.

- Interest is taxable: You may have to pay taxes on interest earned.

- May not outpace inflation: A risk for any savings account, including CDs and other cash-like vehicles, is that inflation might beat your earnings. Compare different CDs to ensure you're getting the best rate you can find. Also, consider other types of investments, especially for long-term goals like retirement.

Shopping Around for CDs

Always compare CDs. Take time to review the financial institution's fine print regarding:

- Any membership or customer requirements.

- The term (length of CD deposit time) that is required to earn the high rate.

- Ease of depositing, withdrawing and managing funds online or with an app.

- Early withdrawal penalties: Amounts and exceptions.

- How often interest compounds.

- Customer reviews of the institution.

How To Find the Best CD Rates

First, check the CD rates at your current credit union or bank. Moving cash from your checking or savings accounts to a CD may be easy.

You can also compare rates at other credit unions and online banks beyond your current financial institution to find the best rate and term combination for your situation. For example, if you don't want to stash money in a CD for more than a year, you'll want to shop for CD rates for terms under 12 months.

Review online resources carefully. Many websites may only display CD rates from credit unions and banks from which they receive a commission.

Rates displayed are usually based on a year's earnings. For example, if you have $1,000 and see an APY advertised as 5%, that means you would earn $50 in interest in one year. But if you only put it in for one month, you'll only earn $4.07.

CD Frequently Asked Questions (FAQs)

When Is Opening a CD a Good Idea?

A CD might be good for you if you already have an emergency fund and can keep a chunk of money in an account for the entire term. If you need to withdraw money early, you might pay an early withdrawal penalty, typically a few months of interest. If you have a significant expense soon, consider savings alternatives.

Are CDs a Good Way to Make Money?

As with most financial decisions, it depends on your individual situation — your goals and how much money you have to invest. It also depends on current rates. CDs often earn a higher interest rate than a savings account, but your earnings don't go up and down like they can with other riskier investments like stocks.

Does a CD Offer an ATM card?

Unlike many other deposit accounts, a CD account doesn't offer a way to access your money easily. This is because the money you've put in the CD is supposed to stay in the account for the set amount of time you agreed to. Other financial accounts offer ATM cards, including checking or money market accounts.

Are CDs Safe?

CDs are generally considered to be a low-risk way to save money. You usually don't have to worry about losing your principal as long as you don't withdraw it early but be sure to check the account disclosures. You can also make sure it's FDIC or NCUA insured.

Smith pointed out that doesn't mean there's zero risk.

For example, you could experience opportunity-cost risk if you could have made more money in a higher-rate CD or the stock market.

The Takeaway: Start With Your Goals

CDs can be an excellent investment to ensure you earn returns on your cash along with the stability and security of an NCUA/FDIC-insured account. It pays to research a credit union or other financial institution and look for competitive rates and easy-to-manage options.

*Where examples are used, the products, rates and returns are not guaranteed and are for educational purposes only. The information and examples are not advice and may not reflect the rates, products, or services currently available from BECU. BECU does not offer or guarantee products or rates in this article.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized financial, tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation when making financial, legal, tax, investment, or any other business and professional decisions that affect you and/or your business.